While you are searching for another render, probably one of the most beneficial things you can do is always to imagine regarding the just what you desire out of your promotion. Due to this i have busted anything down into independent categories in order that we are able to leave you ideas for the best zero put gambling establishment bonuses. Conference during the above tips ought to provide an easy detachment techniques.

Play Tomb Raider On line Slot machines in the uk 2024

Posts

The fresh gameplay of your Tomb Raider slot machine game has a complete level of a dozen other icons. One of them, you might see nine regular of them and you can about three form of ones, for instance the Insane, the newest Spread and also the Added bonus symbol. You’ll instantly rating complete use of our very own on-line casino forum/talk and receive all of our newsletter that have development & private bonuses every month.

Tomb Raider Pokies On line by Microgaming Play 100 percent free Slot

Blogs

Yes, you can indeed along with play Tomb Raider slot on the cellular and you will tablet devices, while this is a relatively dated online game. They operates on the Flash simply, meaning that it’s not really ideal for handheld networks, nonetheless it works. It’s possible to result in the main benefit online game inside totally free revolves element, and this we’ll look closer in the now.

Totally free Real money Gambling enterprise No deposit Extra Gambling on line Local casino Incentives November 2024

Articles

- Cashback Incentive

- How many times perform some better casinos modify their no deposit incentive now offers?

- Prepared to Play? Are One Higher Gambling enterprises

- Ideas on how to Allege a free No-deposit Gambling enterprise Bonus

- Tips Sign in And you will Log on From the Casino Weeks

- Just how do casinos return for the free incentives?

Once you meet with the conditions to help you cash-out, you can preserve everything you’ve earned. No-deposit dollars bonuses usually have a max detachment restriction in order to end abuse of your own venture. Gambling on line systems get demand withdrawal limits to the earnings derived from no-deposit incentives, very hear these types of limits given regarding the words.

Healthy and Delicious: Why Grilled Chicken Should Be Your Go-To Protein

As much as deciding the best protein for a healthy, tasty meal, most people opt for grilled chicken. It contains a great diet that is often hard to come by and bears many tastes when well cooked. If you find yourself in Edmonton and want only the best, then you would be pleased to know that Edmonton has the best places to get grilled chicken in town, together with scrumptious fried chicken.

Now, let’s discuss more about why grilled chicken should be on the menu and where to order the tastiest grilled chicken in Edmonton.

Grilled Chicken – The Nutritional Benefits

1. Rich in Protein

Grilled chicken is a very healthy dish because it contains very little fat. It contains all the seventy essential amino acids in your body that help repair and rebuild muscular tissues. Whether you are exercising in the gym or just want to have a healthy meal, free from fat and full of protein, then grilled chicken is ideal.

2. Low in Fat

If compared to fried chicken this food item is a healthier one as fat is used in the process of frying a chicken. The grilling also removes all the excess fat leaving the outcome perfect pieces of proteins that are free from fats making it an appropriate meal for individuals who are on a diet.

3. Vitamin and mineral-enriched

Chicken is packed with vitamin B6 which aids in increasing energy and phosphorus for healthy bones and teeth. Grilling also preserves nutrients and is far better than frying as a method of cooking.

Why Grilled Chicken Tastes Amazing

1. Natural Smoky Flavor

People prefer grilling since it gives the chicken a natural and smoky taste. When prepared with the right marinades or spices, it’s a delicacy for the tongues or as some would call it, tongue tickling.

2. Versatility in Preparation

There is as much difference in preparing grilled chicken as there is from the different barbecue marinades to the much simpler lemon and herb seasoning. This makes it an indispensable protein if you are preparing a meal at home or buying food from a restaurant.

Grilled Chicken vs. Fried Chicken: Which is Better?

Many prospective customers can be divided into two camps, which are devoted to the grilling and frying techniques used in producing chicken. Inns regarded as health-conscious cuisine, becomes a clear winner with grilled chicken. But if you wish to indulge yourself in some good old comfort food, the best-fried chicken near Edmonton is as delicious but as least as filthily good as eating a burger occasionally.

Grilled Chicken Advantages:

Lower in calories and fat. Preserves protein and vitamins among other nutrients / can retain nutrients. Ideal for anybody into training, exercising, or maintaining an ideal body size.

Fried Chicken Appeal:

Crispy and indulgent.Perfect as a cheat day or a once-in-while indulgence!

Fortunately, Edmonton has great facilities for both!

Why Grilled Chicken is the Best in Edmonton?

Edmonton is indeed a city of foodies and is considered to be providing some of the tastiest grilled chicken known to mankind. Local restaurants then define this abundant protein cut with new innovative recipes prepared with exotic spices. Here’s why grilled chicken in Edmonton stands out:

1. Ingredients Used are Fresh and Locally sourced

Since most restaurants want their clients to return for more, several in Edmonton have the right products sourced and used as supplied and prepared with healthy ingredients.

2. Authentic Flavors

From Indian spices to smoky barbecue rubs Edmonton chefs have a good appreciation of how to handle delicious grilled chicken.

3. Perfect Pairings

Barbecue is normally accompanied by well-cooked vegetables, salads, or even better grains. That way it can turn into a complete meal that also filling and healthy for the body system.

Conclusion:

Whether you are eating in a restaurant or even preparing the meal at home, grilled chicken meals are attractive to those whose desire is a wholesome and yummy meal. It is a favorite meal amongst gourmet lovers in Edmonton and all over the world because of its flexibility, it is a healthy meal, and it is measles with a variety of tasty flavors.

Well, the next time you’re in search of a more than just satisfying meal, why not have the best grilled chicken in Edmonton? Finally, if the mood takes you and you feel like indulging, then it is time to discover the best fried chicken near Edmonton.

They also don’t have to be boring – one of the simplest yet most delicious meals is grilled chicken. Get it today and find out why it is the greatest protein ever!

How to Spice Up Your Fried Chicken for Extra Flavor

Fried chicken is one of the most famous dishes, but people always ask how it can be more delicious. Whether you are making meals at home or searching for the best fried chicken in Edmonton there are several tips to enhance your fried chicken experience. This blog will make it easier for you to apply an extra layer of flavor to your deep-fried chicken so that the taste explodes with flavor. We will also include a list of some of Edmonton’s fried chicken restaurants for individuals who need more time to bother with frying.

The Basics of Fried Chicken

First of all, what makes the concept of fried chicken appealing and appetizing? It has a crisp and homogeneous bright-brown neat skin, and the texture and taste are initially tender and juicy. Laying the chicken into the flavors and deep frying seals the skin and offers the chicken that nice crackling feeling. Nevertheless, adding more heat or flavor to your fried chicken starts with how you season it.

Step 1: You should begin with a tasty marinade.

Another revelation that can help to put features into your fried chicken easily is marinating. A good marinade will help to impart some of its flavors to the meat and will also help it not to become dry when frying.

Buttermilk Marinade: Buttermilk is the traditional soak for chicken before the process of deep frying it. It helps to make the beef more soft and its flavor is slightly sour. To it add hot sauce, cayenne pepper, paprika, garlic powder, and a small pinch of salt to kick it. Let the chicken sit for at least four hours, or best of all, overnight.

Spicy Yogurt Marinade: Another great interstitial is yogurt; it helps the chicken to become tender and juicy. Combine vanilla yogurt with chili powder, ground cumin, turmeric, ginger and garlic. This makes the chicken brightly colored and has a spicy kick to It.

Step 2: Choose the Right Spices for Your Flour Coating

The flour mixture is what makes fried chicken crusty and you can always switch it up by adding a few spices. While still preparing your flour for dredging add spices that are in harmony with your marinade.

- Paprika: Imparts a sweetish smoky touch, gloomy, but not dreary in any way.

- Cayenne Pepper: If you like something hot cayenne pepper is a great one. But you can increase or decrease the amount of it according to how spicy your chicken should be.

- Garlic Powder and Onion Powder: These two add a depth of flavor that reduces the hotness.

- Oregano and Thyme: These herbs impart a cave-like taste that best complements fried chicken.

- Salt and Pepper: One of the oldest and most popular pairs that are perfectly suitable to boost all the other tastes.

For a great-tasting crust, consider adding some cornstarch to your flour to your dough. Cornstarch gives a better, crispier crust and ‘sticks’ to the spices better.

Step 3: Double Dipping for Extra Crunch

Another thing that you need to remember is to double-dip your chicken if you want that extra crispiness on it. After the first round of breading with the spiced flour, immerse the chicken back in the buttermilk or egg wash, then bread it again with the flour. This provides an additional layer that puffs up when deep-fried to give a crunchy texture.

Step 4: Fry at the Right Temperature

As the rule of thumb goes, to achieve a perfect deep-fried chicken one needs to avoid burning it by ensuring that the oil is hot enough. If the oil is too hot, the outside part of the cutlet will turn brown while the inside is still pink in the middle. If you use too little, then your chicken becomes greasy and therefore becomes soggy.

Step 5: Finishing Touches – Sauces and Seasonings

When your chicken is perfectly fried, there is one thing to do: add the garnishing. Here’s where you can experiment with flavors:

Spicy Honey Drizzle: If you would like to bring up your ratings and enjoy what you’re doing, you must incorporate both sweetness and spice into your meal. Sprinkle hot sauce or red pepper flakes together with honey, and then pour it over the deep-fried chicken immediately. Including honey as a sweetener just deploys the heat in a very irresistible manner.

Garlic Butter Glaze: For an even richer taste of your fried chicken, you can soak it in a garlic butter sauce. I melt butter then add minced garlic and toss chicken while it’s still hot. Garlic will blend well with butter and spices to give each bite crusty with the huge taste of garlic.

Spicy Dry Rub: A bonus for lovers of spicy food, use chili powder, cumin, smoked paprika, and garlic powder to season the chicken after frying. This puts in extra to add more heat and a smoky taste.

Conclusion

Wanting to add more flavor to your fried chicken can be a simpler process than you realize. To enhance the taste of traditional fried chicken, one can marinate the chicken, prepare spices in the coating process, and add a fine sauce or glaze that will improve the overall taste significantly. Make sure you also try out some of the best fried chicken restaurants in Edmonton where you can learn how the rest of them did it. From your kitchen to restaurant tables, all you need are a few steps to have those mouth-watering fried chicken meals.

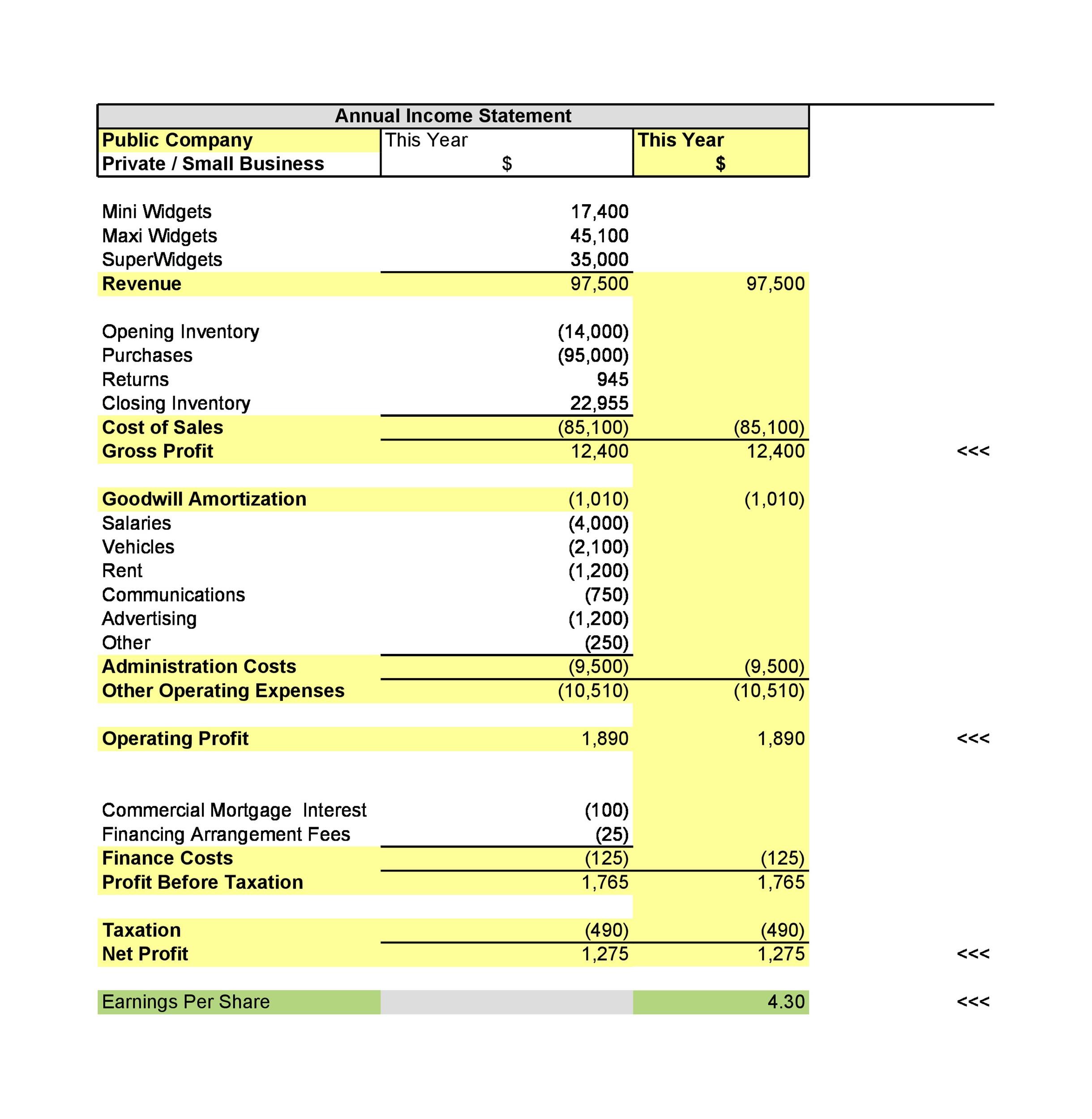

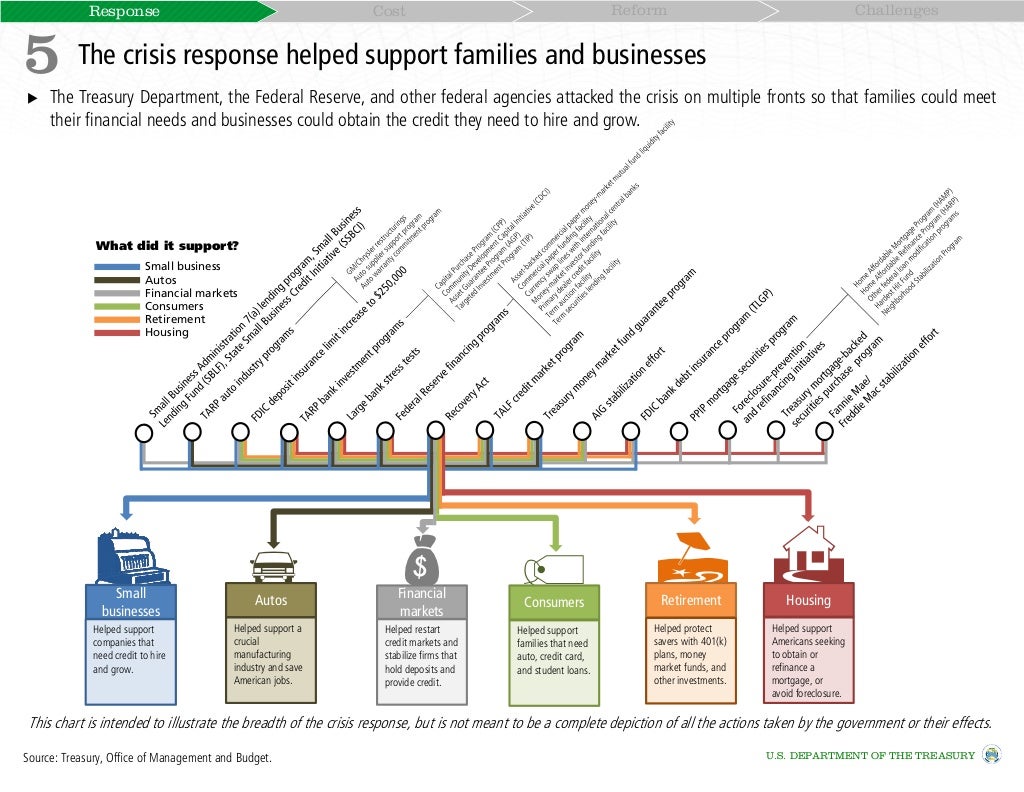

401k limit increases to $23,500 for 2025, IRA limit remains $7,000 Internal Revenue Service

Next, we’ll check out an example to see how it all works with real numbers, kind of like watching a demo. Lastly, we’ll learn how to make one ourselves, step by step, just like following a simple recipe. This way, you’ll see how a business figures out if it’s making money or not. This report tells us if the company earned a profit, which means it made money, or if it had a loss, meaning it spent more than it earned. It lists income, which is all the money earned, and expenses, which are all the money spent.

- Operating income is like the score in a game, showing how well the company did in its main business activities.

- Master the basics of foreign currency accounting—so you can get back to bringing in dollars (or euros, or yen…).

- It tracks the company’s revenue, expenses, gains, and losses during a set period.

- Calculate unit cost first as that is probably the hardest part of the statement.

- Use one of our templates to list the sales, expenses, and other gains or losses in the correct format.

Operating Expenses

Debt interest expense is deducted from operating profit, to determine a company’s taxable income. A good nonprofit chart of accounts can help you avoid a lot of confusion and misunderstandings when it comes to keeping up with all of your important financial information. As the director of a nonprofit (or other high-level leader), you regularly provide your board… All of your financial statements are valuable for helping you run your business. They give you insights into how your money is doing and whether or not there are potential problem areas to address. Small business owners are often intimidated by having to create a traditional income statement for their company.

Calculate the selling expense and the administrative expense

Interest refers to any charges your company must pay on the debt it owes. To calculate interest charges, you must first understand how much money you owe and the interest rate being charged. Accounting software often automatically calculates interest charges for the reporting period. If your goal is to grow a profitable business that stands the test of time, you need to pay close attention to your income statements.

Differences between an income statement vs. balance sheet

The report ends with a total that shows the final result, either a gain or a loss. Whether you’re an individual contributor, a leadership team member, or an entrepreneur wearing many hats, knowing how to write an approve and authorize an expense claim in xero income statement provides a deeper understanding of the financial state of your business. It can also help improve financial analysis, allowing you to plan for the future and scale your business successfully.

Types of Companies in Managerial Accounting

It’s a key part of checking a company’s financial health and figuring out if it’s making enough money to keep going. It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs. A P&L, which stands for profit and loss, indicates how the revenues are transformed into net profit.

SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA.

Below is a 10-step guide on how to write a professional income statement. Using this process, along with the FreshBooks income statement template, allows you to simply fill in the details rather than spending time creating an entire document from scratch. If you have found yourself struggling to find the time to create your own profit and loss report, or P&L, from scratch, a free invoice statement template is the perfect solution. Accurate records of expenses, revenues, and credits are required for tax purposes and can help keep you in compliance with tax regulations.

This tallies the costs to produce goods or services sold in the period. It includes direct costs such as raw materials, production labor, and shipping. GAAP also requires companies to include some portion of their indirect expenses—called selling, general, and administrative costs (SG&A)—in calculating COGS. This is known as absorption-costing or full-costing, and it allows companies to reflect all of the costs of production. An alternative called variable costing excludes indirect costs for a lower COGS. The traditional income statement is one of three key financial statements, along with the balance sheet and cash-flow statement, prepared regularly by companies, usually each quarter and year.

Often shortened to “COGS,” this is how much it cost to produce all of the goods or services you sold to your customers. If the company is a service business, this line item can also be called Cost of Sales. How you calculate this figure will depend on whether or not you do cash or accrual accounting and how your company recognizes revenue, especially if you’re just calculating revenue for a single month. Comparing these numbers, you can see that just over 30% of Microsoft’s total sales went toward costs for revenue generation. These are all expenses that go toward a loss-making sale of long-term assets, one-time or any other unusual costs, or expenses toward lawsuits. Payment is usually accounted for in the period when sales are made or services are delivered.

Instead of focusing on the fear and anger, she started her accounting and consulting firm. In the last 10 years, she has worked with clients all over the country and now sees her diagnosis as an opportunity that opened doors to a fulfilling life. Kristin is also the creator of Accounting In Focus, a website for students taking accounting courses. Since 2014, she has helped over one million students succeed in their accounting classes. Any interest on business loans or other debt obligations must be paid from operating profit. Widget Wizard’s selling, general, and administrative expenses totaled $25 million for the period.

New Post

12 Best Tucson, AZ Bookkeeping Services

1-800Accountant, America’s leading virtual accounting firm for small businesses, offers seamless end-to-end bookkeeping and accounting services in Tucson, Arizona. Our experts provide you with peace of mind and the extra time you need to focus on building your business. Bench is proud to offer bookkeeping services to businesses across the United States. We The Significance of Construction Bookkeeping for Streamlining Projects are here to help you streamline your accounting needs efficiently and effectively. With online bookkeeping services and real human support, Bench is the expert financial solution your business deserves.

Taxes

Bench’s pragmatic approach mirrors the frontier spirit and entrepreneurial energy that thrives in the Old Pueblo. We understand the state’s Transaction Privilege Tax, Use tax and the varying city tax codes, and ensure your business is always in line. You’ll have peace of mind knowing the accounting professionals at Bench are by your side, making sure your books are balanced and your taxes are done right. Founded in 2009, Precision is a bookkeeping, payroll, and https://azbigmedia.com/real-estate/commercial-real-estate/construction/how-to-leverage-construction-bookkeeping-to-streamline-financial-control/ virtual assistant service provider that caters to small businesses in the Tucson area.

Expertise.com

- If you are struggling with keeping up with the bookkeeping tasks for your Tucson business, you need to hire a professional.

- BooksTime understands the importance of streamlining internal processes and submitting reports created in accordance with recent standards.

- Discover how we can help you have better finances with a personalized demo from a Bench expert, ready to answer all your questions.

- Through AMS, every state employee seeks to understand customer needs, identify problems, improve processes, and measure results.

- The accountant helps business owners manage payroll and daily accounting, as well as providing up-to-date advice to streamline financial practices.

- The company’s website features a helpful information blog that has money-saving coupons, and first-time customers receive a free initial consultation.

The company’s website features a helpful information blog that has money-saving coupons, and first-time customers receive a free initial consultation. Gnesist is an accounting firm helping Tucson residents and businesses minimize liabilities and achieve regulatory compliance. It provides bookkeeping services, including invoice creation, processing, and tracking, additionally calculating employee wages, deductions, and benefits.

Business Setup

We signed on with Adam’s accounting group after bouncing around trying to find the right ‘fit’ with other companies. I knew immediately that we found what we needed when Adam took the time to sit down and talk to me about my business, my plans, my goals and where I wanted my company to be in the next 2, 5, 10 years. Adam and his team are responsive – and by that, I mean proactive – which is probably the single best reason to use Dark Horse. After 8 years and 3 different accounting firms we found what we need with Dark Horse.

Accounting for Non-Profits

Bookkeeping services help businesses to control resource allocation and optimize internal processes. Getting assistance from experienced providers is a prerequisite to managing multiple projects successfully and increasing profits. Rising Star Accounting Services, LLC offers free initial consultations, personalized attention, and a range of professional accounting services backed by over a decade of experience. The company also provides accounting software setup and training, and customers can call or contact the company on the website to schedule an appointment.

The term is commonly used to describe working financial management practices and the best approaches to categorizing expenses. Small and medium-sized businesses (SMBs) often find it difficult to keep their financial reports in order. Large corporations also may struggle to evaluate the resources spread across different departments. Companies of all sizes use third-party construction bookkeeping services to maintain strong positions in a changing environment.

Minimize your tax liability and maximize financial stability with a well-devised plan. A well-thought-out tax plan helps you stay financially secure in the long run. Discover how we can help you have better finances with a personalized demo from a Bench expert, ready to answer all your questions. We use Plaid, which lets you securely connect your financial accounts to Bench in seconds. This feature saves you the time and effort of manually uploading documents.

- A secure online portal is used for the submission of receipts and categorization of expenses.

- We’ll work with you to connect accounts and pull the financial data we need to reconcile your books.

- We understand the state’s Transaction Privilege Tax, Use tax and the varying city tax codes, and ensure your business is always in line.

- I knew immediately that we found what we needed when Adam took the time to sit down and talk to me about my business, my plans, my goals and where I wanted my company to be in the next 2, 5, 10 years.

- They’d rather focus on more important things — like building a thriving, successful business–without getting buried in everyday tasks.

Its experts also prepare, review, and file state and federal income taxes, utilizing financial management tools such as QuickBooks, Xero, and Gusto. With a team of over 200 financial professionals, Gnesist delivers integrity-driven support to more than 1,000 businesses across diverse industries. Based in Tucson, Arizona, Bench understands the unique business landscape of this vibrant city.

Business model change leads to productivity growth

Use the variable cost per unit and the fixed cost to create a cost formula that can be used to estimate the total cost at any level of activity. Understanding cost behavior helps in budgeting and setting pricing strategies by predicting how total costs will change with business activity. This is the point at which the activity level exceeds or falls below the relevant range and causes a change in the step cost amount. The step change point can be calculated by multiplying the step cost amount by the number of units or customers or hours within the relevant range.

Accounting Unveiled: Decoding Financial Mysteries

Before we dive into the different ways of measuring brand equity, let’s first understand what it is…

Step Costs

Mixed costs, also known as semi-variable costs, possess characteristics of both fixed and variable costs. They consist of a fixed component that remains constant and a variable component that changes with activity levels. An example of a mixed cost is a utility bill, which includes a fixed monthly charge and a variable charge based on usage. The contribution margin is the difference between sales revenue and variable costs.

Understanding Small Business Financial Management

The high-low method is easy to apply and does not require sophisticated tools or calculations. It only uses two data points, which may not be representative of the entire data set. It also assumes a linear and constant cost behavior, which may not be realistic in some situations. It is sensitive to outliers and may produce inaccurate results if the highest and lowest levels of activity are not normal. CVP analysis uses cost behavior information to determine the break-even point, margin of safety, and target profit levels. An example of a mixed cost is the cost of a salesman’s salary, containing both a basic salary( fixed cost) and a commission on sales made( variable cost).

- Historical data can also help to identify the cost drivers, which are the variables that have the most impact on the total cost.

- There are also mixed costs, which have both fixed and variable components.

- Examples of fixed costs include rent, salaries of top management, and property taxes.

- The fixed cost is the amount of cost that does not change with the level of activity.

- We have also discussed how to use various methods, such as scatter plots, high-low method, and regression analysis, to analyze cost behavior and estimate the cost function.

- For example, the cost of electricity may vary depending on the number of machine hours used, but only within a certain range of machine hours.

Understanding cost behavior is essential in the financial management of a business. As a matter of fact, it has an immense influence on the strategic decisions made by organisations. We can help businesses make informed choices about pricing, production, and resource allocation by recognising how costs change in response to changes in activity levels.

Financial Planning and Management for Sustainable Business Growth

On the other hand, businesses with high variable costs may need to focus on pricing strategies that allow them to absorb fluctuations in costs and maintain profitability. Mixed costs, also known as semivariable costs, have both fixed and variable components. A portion of the cost remains constant, while another portion varies with activity. Examples of mixed costs include utilities, telephone expenses, and maintenance costs.

Relevant activities are those that cause the costs to change, such as sales, production, or service delivery. Fixed costs play a crucial role in the cost structure of a business. They provide a baseline level of expenses that must be covered regardless of the level of activity. For example, even if a manufacturing plant is not producing any units, can you claim your unborn child on your taxes fixed costs such as rent and insurance still need to be paid. As such, understanding fixed costs is essential for budgeting and forecasting purposes, as they represent a significant portion of the total cost structure. Fixed costs have no impact on the marginal cost of producing additional units since they do not change with production levels.

Semi-variable costs are common in many business situations, such as utilities, maintenance, salaries, advertising, and depreciation. For example, a company may pay a fixed monthly fee for its internet service, plus a variable charge based on the amount of data used. Or, a salesperson may receive a fixed salary plus a commission based on the sales volume. Let’s look at some examples of step costs and how to identify the thresholds in activity levels that trigger a change in them.

Cost behavior is a crucial concept that plays a significant role in decision making and profitability. It describes how costs change in response to variations in activity levels within a business. Understanding cost behavior helps organizations make informed decisions regarding pricing, production levels, and resource allocation.

CVP graphs visually represent the relationship between costs, volume, and profit. These graphs provide a clear picture of how changes in volume impact costs and profitability. By analyzing CVP graphs, businesses can make informed decisions regarding pricing strategies, cost control measures, and production levels. Cost behavior is the study of how costs change in response to changes in the level or nature of business activity. One of the key aspects of cost behavior is identifying the factors that influence how costs behave. Cost drivers are the variables or events that cause a change in the total amount of a cost.

They are essential for calculating the minimum level of sales or production required to cover all costs and avoid losses. Understanding fixed costs is vital for effective budgeting, forecasting, and decision-making within an organization. Understanding cost behavior is essential for businesses to effectively manage their finances and make informed decisions. By analyzing cost behavior patterns, businesses can optimize their cost structure, accurately estimate costs, and forecast future expenses. This knowledge empowers businesses to navigate the dynamic economic landscape and achieve financial success. In Business Studies, understanding cost behavior patterns can be a game-changer when it comes to planning, budgeting, and controlling costs.