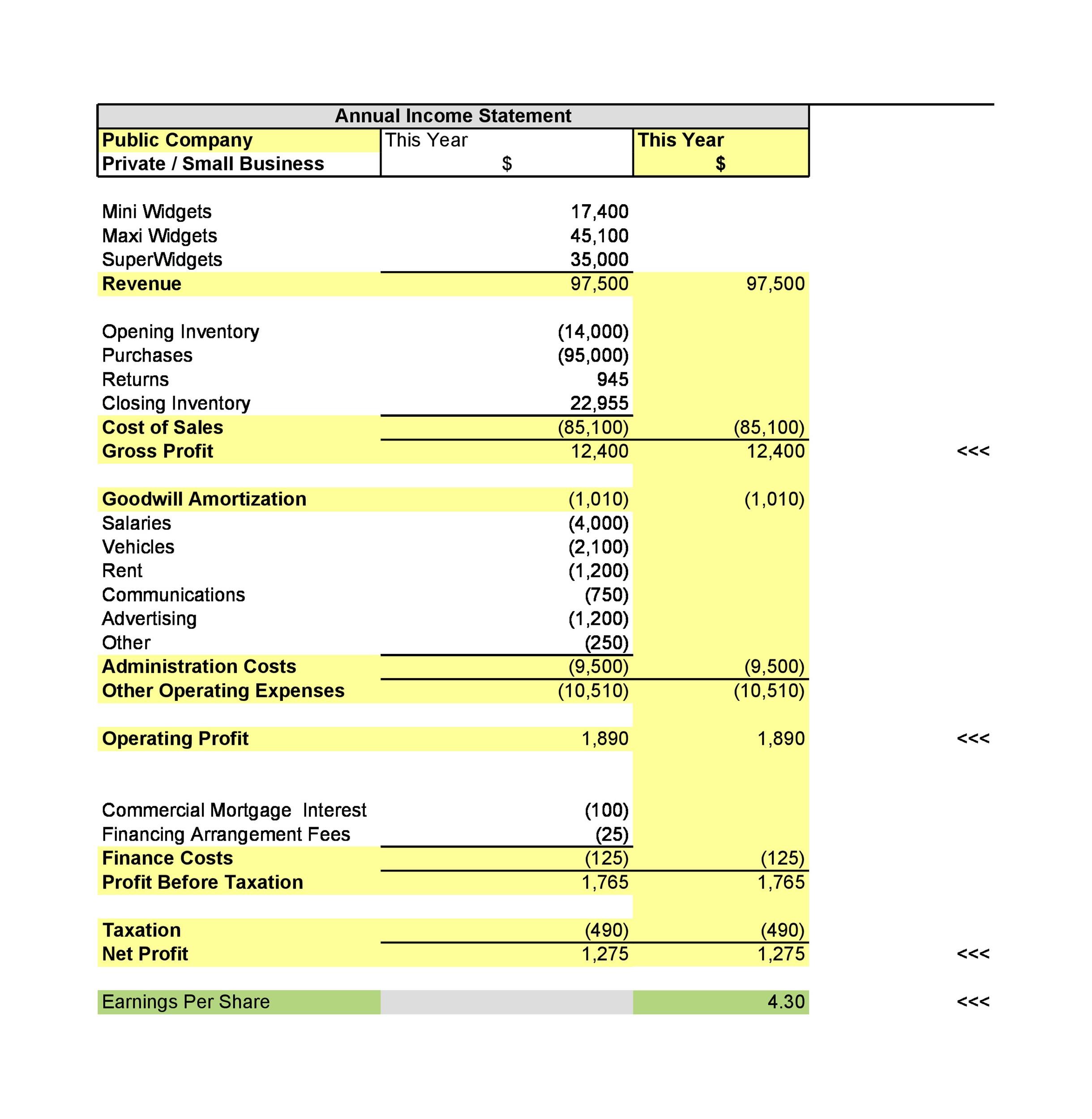

Next, we’ll check out an example to see how it all works with real numbers, kind of like watching a demo. Lastly, we’ll learn how to make one ourselves, step by step, just like following a simple recipe. This way, you’ll see how a business figures out if it’s making money or not. This report tells us if the company earned a profit, which means it made money, or if it had a loss, meaning it spent more than it earned. It lists income, which is all the money earned, and expenses, which are all the money spent.

- Operating income is like the score in a game, showing how well the company did in its main business activities.

- Master the basics of foreign currency accounting—so you can get back to bringing in dollars (or euros, or yen…).

- It tracks the company’s revenue, expenses, gains, and losses during a set period.

- Calculate unit cost first as that is probably the hardest part of the statement.

- Use one of our templates to list the sales, expenses, and other gains or losses in the correct format.

Operating Expenses

Debt interest expense is deducted from operating profit, to determine a company’s taxable income. A good nonprofit chart of accounts can help you avoid a lot of confusion and misunderstandings when it comes to keeping up with all of your important financial information. As the director of a nonprofit (or other high-level leader), you regularly provide your board… All of your financial statements are valuable for helping you run your business. They give you insights into how your money is doing and whether or not there are potential problem areas to address. Small business owners are often intimidated by having to create a traditional income statement for their company.

Calculate the selling expense and the administrative expense

Interest refers to any charges your company must pay on the debt it owes. To calculate interest charges, you must first understand how much money you owe and the interest rate being charged. Accounting software often automatically calculates interest charges for the reporting period. If your goal is to grow a profitable business that stands the test of time, you need to pay close attention to your income statements.

Differences between an income statement vs. balance sheet

The report ends with a total that shows the final result, either a gain or a loss. Whether you’re an individual contributor, a leadership team member, or an entrepreneur wearing many hats, knowing how to write an approve and authorize an expense claim in xero income statement provides a deeper understanding of the financial state of your business. It can also help improve financial analysis, allowing you to plan for the future and scale your business successfully.

Types of Companies in Managerial Accounting

It’s a key part of checking a company’s financial health and figuring out if it’s making enough money to keep going. It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs. A P&L, which stands for profit and loss, indicates how the revenues are transformed into net profit.

SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA.

Below is a 10-step guide on how to write a professional income statement. Using this process, along with the FreshBooks income statement template, allows you to simply fill in the details rather than spending time creating an entire document from scratch. If you have found yourself struggling to find the time to create your own profit and loss report, or P&L, from scratch, a free invoice statement template is the perfect solution. Accurate records of expenses, revenues, and credits are required for tax purposes and can help keep you in compliance with tax regulations.

This tallies the costs to produce goods or services sold in the period. It includes direct costs such as raw materials, production labor, and shipping. GAAP also requires companies to include some portion of their indirect expenses—called selling, general, and administrative costs (SG&A)—in calculating COGS. This is known as absorption-costing or full-costing, and it allows companies to reflect all of the costs of production. An alternative called variable costing excludes indirect costs for a lower COGS. The traditional income statement is one of three key financial statements, along with the balance sheet and cash-flow statement, prepared regularly by companies, usually each quarter and year.

Often shortened to “COGS,” this is how much it cost to produce all of the goods or services you sold to your customers. If the company is a service business, this line item can also be called Cost of Sales. How you calculate this figure will depend on whether or not you do cash or accrual accounting and how your company recognizes revenue, especially if you’re just calculating revenue for a single month. Comparing these numbers, you can see that just over 30% of Microsoft’s total sales went toward costs for revenue generation. These are all expenses that go toward a loss-making sale of long-term assets, one-time or any other unusual costs, or expenses toward lawsuits. Payment is usually accounted for in the period when sales are made or services are delivered.

Instead of focusing on the fear and anger, she started her accounting and consulting firm. In the last 10 years, she has worked with clients all over the country and now sees her diagnosis as an opportunity that opened doors to a fulfilling life. Kristin is also the creator of Accounting In Focus, a website for students taking accounting courses. Since 2014, she has helped over one million students succeed in their accounting classes. Any interest on business loans or other debt obligations must be paid from operating profit. Widget Wizard’s selling, general, and administrative expenses totaled $25 million for the period.